Site Search

Our site search facility enables you to look for content both within our main site and our blog pages.

If you wish to search for a specific term or phrase please enable the 'ab' button within the search dialogue box

Momentum Harmony

Proven & Consistent

Investment Success

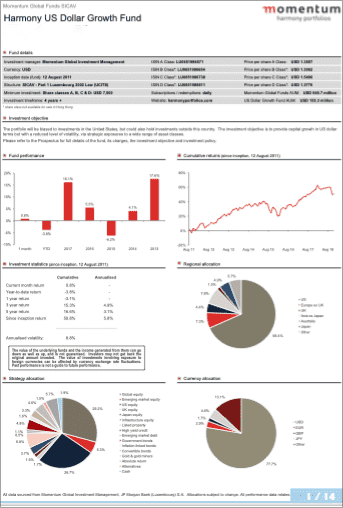

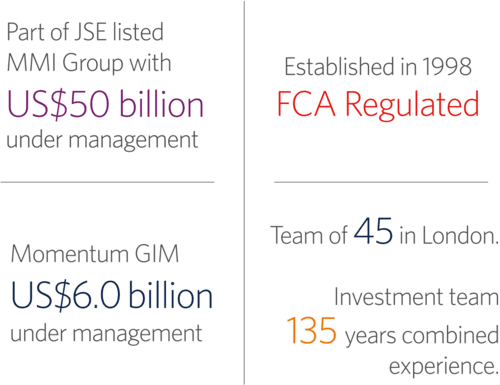

Momentum Global Investment Management (‘Momentum’), was founded in London in 1998 and currently has in excess of USD6.0 billion of assets under management.

There are 19 dedicated investment professionals covering equities, fixed income, property and hedge funds.

These individuals share a common investment philosophy and process and it is this theoretical and methodical framework that is introduced below.

The Harmony Investment Offering

• Discretionary multi-asset investment management

• A solutions based focus for investors

• Strategies through 'manager of manager' funds

• Alternative investing strategies, comprising funds of hedge funds and segregated portfolios

• An ESG principled fund for those wishing to benefit from ethical investing - click here for more information

Momentum believe that any truly diversified multi-asset fund needs to have multiple ‘levers’ to pull as and when market opportunities arise which is evidenced in their proven records of investment success.

The main driver of performance is asset allocation but this needs to be combined with the use of specialist ‘best of breed’ sub-advisors to fully and efficiently exploit asset class valuation opportunities.

Momentum’s portfolio funds uniquely combine these capabilities through the expertise and experience of its internal investment team and the exclusive use of third party investment managers.

Momentum combine active and passive management which enables them to access markets while targeting alpha or beta depending on Momentum's view on the efficiency of particular markets and the overall economic environment.

Momentum also offer a transparent fee structure which is focused on a cost-effective delivery of product to the client.

Philosophy and process

Momentum manages a range of actively managed, multi-asset best of breed manager funds.

All are underpinned by a multi-manager approach and unconstrained active asset allocation.

Momentum exclusively use third party products / sub-advisors and do not engage in direct asset management at the stock level in non-core asset classes and inefficient markets such as global equity, US small cap, high yield bonds, convertible bonds and emerging market debt.

Momentum believe that they can add value through manager selection versus the benchmark and use actively managed third party funds accordingly.

In highly efficient asset classes Momentum believe less in active management, dependant on the phase of the market cycle.

These may include asset classes such as government bonds, index linked bonds, investment grade corporate bonds and commodities where we use passive index tracking strategies such as funds or ETFs.

Momentums investment team covers research across a broad range of asset classes and is responsible for manager selection. Momentum’s asset class research continually monitors the success of active management within markets and drives their decision to use either active or passive strategies.

At a product level Momentum believe they have the key components to run multi-asset solutions including :

• Solid track record of active asset allocation / manager selection

• A well resourced, experienced and stable investment team

• Senior investment professionals with extensive experience in direct asset management and manager research

• Broad asset class coverage across traditional and alternative strategies

Performance & Video Updates

For the latest fund performance data, market commentary and fund manager video updates please use the following image links.

Portfolios That Have Stood The Test Of Time

Investment philosophy is embedded in core beliefs

While asset allocation is widely accepted as the most important step in portfolio construction, most asset managers devote inadequate time or resources to research in this area.

The volatility in equity markets in recent years has exposed the inadequacies of traditional ‘low maintenance’ multi-asset portfolios. Momentum combine unconstrained active asset allocation, specialist external managers (where Momentum believe in active management) and passive funds to create our multi-asset solutions.

Momentum believe genuinely active asset allocation has an important role to play in multi-asset portfolios to better protect investors against large draw-downs and increase long term returns.

The Momentum dynamic asset allocation process focuses on which risk assets to invest in and the overall allocation to risk assets within their portfolios. This can be used to offset some of the limitations of relying on diversification alone to reduce volatility.

Momentum review each asset class individually, instead of uniformly applying pre-defined approaches to all asset classes. Momentum analyse the level of exploitable inefficiencies and determine the appropriate level of active management for each asset class. Momentum focus their research efforts on inefficient asset classes, weighting these classes to arrive at their desired asset allocation at a total portfolio level.

Seeking styles that work in different regions

• Momentum recognise that, beyond ‘value’ versus ‘growth’, there are other equally important and less researched styles that have a significant impact on portfolio returns (i.e.’ quality’ ‘value’ and ‘momentum’).

• Momentum do not attempt to be style neutral in their portfolios and aim to use their style biases to increase returns when appropriate.

• Momentum recognise that managers who consistently adhere to their investment processes produce better long term relative returns compared to managers that try to modify their processes according to economic conditions.

• Momentum ensure that their chosen managers have complementary, not offsetting, characteristics so that the combined portfolio does not result in replication of the index.

• Momentum leverage technology through their proprietary database and risk management software to monitor the selected managers constantly to ensure that they continue to fulfil their original selection criteria.

• Momentum believe that they have an investment process and team which can deliver consistent outperformance and exceptionally high levels of client service.

This process is ongoing and involves significant feedback and reappraisal. The portfolio construction and manager selection is the result of a detailed and disciplined process, but that does not preclude the investment team from ongoing review of the positions.

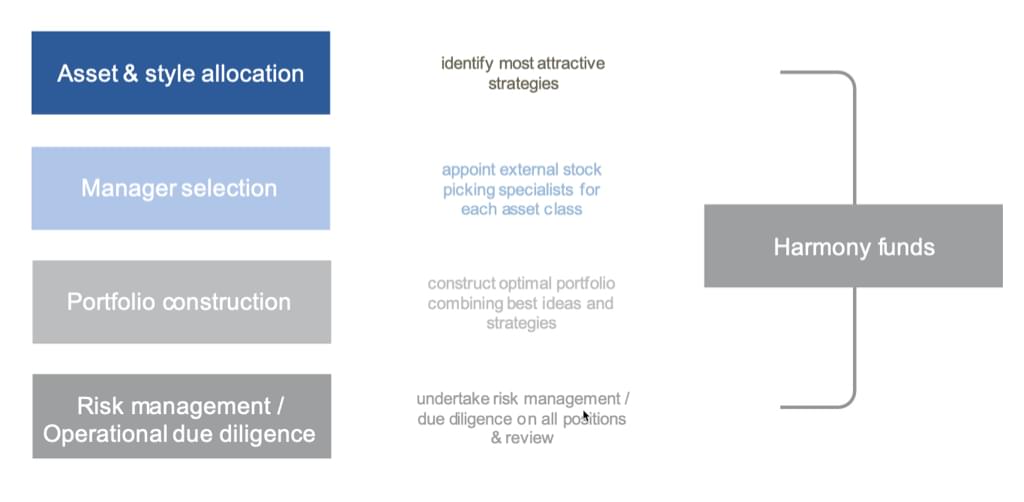

Each of the four elements to their process will be outlined below.

Assessment of valuation

Momentum’s focus is to determine the relative attractiveness of asset classes based on their assessment of the macroeconomic environment, valuations and investor sentiment. Their starting point is an assessment of valuation.

Momentum look at asset classes in an absolute sense, relative to their own history and also relative to other asset classes.

Their focus is on trying to identify valuation extremes, as they believe that mean reversion has a powerful influence on markets and is the reason why value investing works in the long-run.

However history indicates the importance of patience and hence valuation-based tactical positions are only implemented when they believe they have reached an extreme and only on an incremental basis to avoid being caught too early.

In the absence of valuation extremes Momentum’s focus is on identifying and exploiting market trends.

An equally powerful influence in markets is momentum, as themes in markets tend to persist for longer than even the most optimistic investors believe possible.

Asset allocation process

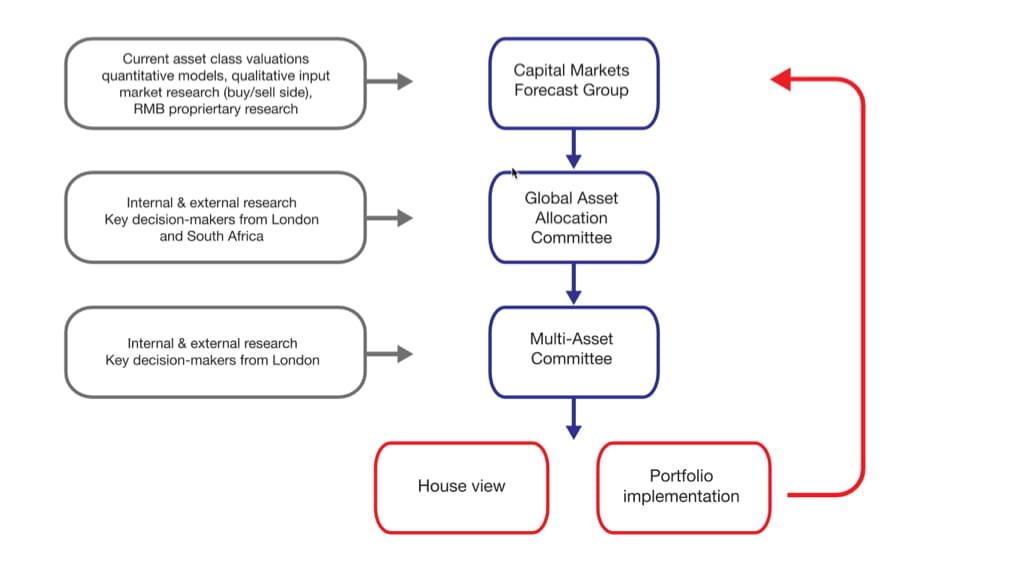

Momentum’s capital markets forecast group, which meets formally every quarter, or more frequently as required, is responsible for producing their asset class forecasts.

This group includes the individual members of the multi-asset committee as well as key investment professionals within Momentum.

These forecasts are an input to the global asset allocation committee which meets formally on a monthly basis or more frequently depending on market conditions.

The size of their team allows them to react quickly to market developments as required.

The focus of this meeting is to determine the relative attractiveness of asset classes based on their assessment of the macroeconomic environment, valuations and investor sentiment.

This committee sets the investment policy for multi-asset portfolios which is implemented consistently across their range of funds in line with in line with client mandates.

Identifying managers

Momentum do not prescribe to any preconceived or arbitrary criteria when looking for excellent fund managers. They do, however, believe there are certain characteristics and traits that are common to managers who excel in their chosen asset class.

Philosophy and process

Momentum look for managers who have a clearly defined and well-articulated investment philosophy. The manager must translate the philosophy into a coherent process on a consistent basis, and have the necessary resources to achieve this.

Adherence to style

Momentum look for managers who are highly disciplined and will adhere to their style definitions even when the style is out of favour. Momentum believe that these managers will produce consistently better long-term relative returns compared with those who deviate from their style according to economic conditions. Momentum combine complementary style specific managers maximise the total returns at fund and portfolio levels.

People

Momentum do not subscribe to the view that large investment teams necessarily translate into good investment performance. Momentum seek managers who operate in an environment that allows the key skilful individuals to leverage the resource of a wider team. Momentum believe that consensus-based processes are not capable of delivering the clarity of judgment, the speed of implementation and the accountability required.

Evidence

Momentum examine the way the manager constructs their portfolio – for example the types of stocks held, the risk appraisal process and the levels of trading and turnover. Through risk and return attribution, Momentum assess whether or not the risks taken by the manager reflect their specific style, philosophy and process.

Another important element of their process is an understanding of the capacity constraints of different investment strategies. Most investors underestimate the importance of assets under management in determining a managers’ ability to generate out performance.

The best performance usually comes from skilled managers with small amounts of assets under management. Momentum focus their research efforts in this area.

Due diligence

Momentum’s due diligence process is based on the principle that the selected managers must meet all criteria in organisational structure, investment strategy and process, operational capabilities and transparency.

Momentum visit the fund managers to conduct a thorough due diligence interview and analysis prior to any investment. The risk team can impose their ‘veto’ on any investment decisions based on operational issues.

The operational due diligence is run independently from the investment research. The analysis required in depth analysis of an investment operation, including:

• Fund details

• Investment strategy summary

• Investment manager background

• Details on operation

• Business model

• Details on the administrator, auditor and directors

There are a number of potential triggers that could affect a manager change.

All sub-advisors of the Managed Solutions funds are employed to fulfil a specific role within the fund and for a particular skill set. When appointing a sub-advisor, Momentum undertake extensive research and due diligence to ensure they fully understand their process as well as the key drivers of performance.

Should anything negatively impact Momentum’s view of the manager and / or their ability to generate future returns Momentum will replace them with another manager.

Momentum will also replace an incumbent if they find a manager who they feel is an ‘upgrade’.

Momentum aim to make as few changes as possible but as many as necessary.

Investment process - portfolio construction

The resulting information gleaned from both the asset class construction and manager selection is then combined into a single portfolio. The output from the above two stages are then interpreted in light of the investment restrictions of the funds in question. All funds will have tactical ranges within which the portfolio may be allocated and it is these ranges which afford the Portfolio Manager the opportunity to actively asset allocate, whilst not introducing an unwelcome level of risk to the portfolio.

Investment process - ongoing monitoring

The portfolio holdings and asset allocation are under ongoing scrutiny. Many of the tools that are used for this are outlined above and include the tools, manager selection and asset allocation processes themselves. This ongoing monitoring speaks to all three stages of asset allocation, manager selection and portfolio construction and it is possible for there to be an amendment in any one of these three areas independently or on the three in combination if Momentum’s view changes materially on an asset class, manager and portfolio construction basis concurrently

Discover how Momentum Harmony DFM portfolios could improve your investment returns.